News

Sinclair isn’t the best value anymore

Despite the constant “renew our levy” and it won’t create any new taxes, someone still needs to explain why Montgomery County Residents are paying more for Sinclair than Clark County residents are paying for Clark State, which has no property tax burden.

And, according to Community College Review, Sinclair is now more expensive than 4 other community colleges in Ohio- none of which extract a pound of flesh from every property owner to support their mission.

To be clear, tuition revenue in 2020 was $30.7 Million, and Property Tax revenue was $38.4 Million. State appropriations was another $49.5 Million. And when you add in Federal money of $22.2 Million, you soon realize that there is a reason Sinclair has zero debt (unlike every other Community College) and a fat reserve.

Those figures are from the State Auditor’s site. That’s $110.1 Million, over 3x tuition. If tuition only is a third of their revenue, please explain how a smaller percentage of their students paying double- amounts to any kind of contribution to the whole.

We’re not against Sinclair- we’re just against the unequal burden supporting a school that’s expanded outside of our county- without asking for the same hand out from property tax owners.

If these other 4 schools can deliver a less expensive education without a property tax levy- why are the taxpayers of Montgomery County still being hammered to pay for Sinclair?

- North Central State College $2,119 in-state

2441 Kenwood Circle Mansfield, OH 44901 - Belmont College $2,786 in-state

68094 Hammond Road Saint Clairsville, OH 43950 - Stark State College $3,686 in-state

6200 Frank Ave NW North Canton, OH 44720 - Clark State Community College $3,359 in-state

570 E Leffel Ln Springfield, OH 45501 - Sinclair Community College $3,438 in-state

444 W. Third St. Dayton, OH 45402

Only Sinclair has been subsidized by a property tax for over 50 years and continues to operate this way.

Keep Sinclair Fair finally recognized in Dayton Daily

After 52 years of paying for Sinclair levies without public organized opposition, the Keep Sinclair Fair movement finally gets a mention in the Dayton Daily News:

After 52 years of paying for Sinclair levies without public organized opposition, the Keep Sinclair Fair movement finally gets a mention in the Dayton Daily News:

But, a local group led by David Esrati said Montgomery County tax dollars are being used elsewhere.

In response to Issue 4, Esrati started an political action committee called “Reconstructing Dayton” and a website called Keep Sinclair Fair. The website encourages residents to vote against the renewal this fall.“I’m sure they’re spending Montgomery County tax dollars in other counties. You can’t have a branch campus in Warren County and have all the support … all the things that go along with it,” Esrati said. “That is not covered for $47 extra a credit hour.

”It’s not fair, said Esrati, that Sinclair has locations in neighboring counties but that residents of those counties are not taxed.

He pointed to Sinclair’s interest in buying Far Hills Church on Clyo Road as evidence because it sits immediately next to Wilmington Pike, which serves as the Greene County line. Sinclair may convert the 100,000 square-foot church and the 40 acres it sits on into a new learning center for $6 million to $10 million.

Esrati called for all counties Sinclair has facilities in to be taxed since Montgomery County residents already pay for Sinclair. Sinclair has locations in Preble County, Greene County, Warren County and a Huber Heights location that serves people from Miami, Montgomery and Greene counties.

Levies are not needed in other counties because Sinclair’s operations are substantially smaller than in Montgomery County, Johnson said. Although Sinclair has the authority to put a tax levy on the ballot in Warren County, Johnson said county leaders do not think one is needed right now.

“If at some time the leaders of Warren County want to have a levy … and want to have lower tuition and they want to have more programs and a bigger campus and all that stuff we’d be interested in talking to them about that,” Johnson said. “But, at this point in time, you know, the very small, modest thing that it is, is what it is.”

Source: Sinclair asks voters to renew $28M levy

The reality is, Sinclair is providing programs all over the region. Dayton School Board member John McManus is teaching high school government classes in Clark County, and then of course, there are branch campuses. Yet, Steven Johnson is still thinking other counties might “volunteer” to add a tax levy to support Sinclair Services.

Why should they? Sinclair is fine just taxing Montgomery County to death, and providing services and their brand without

Sinclair increases student fees for student center

After Sinclair put the renewal levy on the ballot, promising “no increase in taxes” they had no problems increasing fees on their students. What’s worse, is this is just an end run around a tuition increase that they were going to charge- but couldn’t because the governor put a freeze on tuition increases.

So- they call it a fee, for a “Career Services Center”- which is great for the construction companies, the architects and the big companies that pay no property taxes- yet hire Sinclair grads to keep them in business- like CareSource, Premier Health and Kettering Health Network.

Read how Dr. Johnson explains his fee hike- you already approved it- but couldn’t do it as a tuition hike, so we’ll turn it into a fee.

Sinclair Community College’s board of trustees has approved measures to increase student fees and allocate money for a new students services center.

Sinclair students will begin paying a $7 per-credit-hour career services fee in spring 2018. The fee comes as Sinclair had planned to increase tuition by $7 before plans for that were nixed when Gov. John Kasich vetoed tuition increases at community colleges until fiscal year 2019.

“This seven dollars is actually a revisiting, a redo of the $7 that you had already decided on back in June,” said president Steve Johnson.Sinclair’s board also allocated $13 million for an integrated students services center that will serve as a “front door” on the downtown Dayton college campus. The state will chip in $2.5 million while Sinclair will get the remaining $10.5 million from its reserve fund.

Source: Sinclair approves student fee increase, money for student center

Sinclair has a lot of money in its reserve fund, and no debt. The only public institution that doesn’t carry debt, because Montgomery County home owners have been funding their campuses for the last 52 years.

Now that they have a branch campuses in Warren County, Preble County and Greene county- it’s time to tax them too- and lower our taxes.

The argument that those residents pay double covers the costs is an outright lie- if that was truly the case, just double the tuition in Montgomery County and let the property tax go away.

Sinclair looking to buy church for yet another campus

The sprawling downtown campus isn’t enough for Sinclair President Steven Johnson, he now wants to buy a church in Centerville to turn into yet another branch campus. Apparently, it’s too far for people in Northern Warren County and the South Suburbs to drive to downtown- or he just wants to help his buddies at Premier Health have a campus closer to their new mini-hospital.

Sinclair officials have been in talks to purchase Far Hills Church in Centerville. The college could spend between $6 million and $10 million on the 40-acre property near Interstate 675 in southeast Montgomery County, officials said in July.

Sinclair has signed a refundable purchase option, giving it first right of refusal on the sale of the property, Johnson has said.

Source: Sinclair approves student fee increase, money for student center

Of course, Premier is one of the companies that doesn’t pay property taxes on their hospitals, hires their own private police force and gives a lot of money to the Sinclair Levy drive- because Sinclair trains all their new nurses (who aren’t allowed to unionize) and med techs- for next to nothing.

The question is, why do Montgomery County taxpayers have to keep paying and paying for Sinclair campuses when the taxpayers in Warren County don’t pay anything for their “Courseview campus?”

It’s time to say no to the Sinclair levy- until Warren, Preble and Greene counties also pay for Sinclair- and keep Sinclair Fair.

Sinclair Community College one of the worst values

Almost every public institution is worried about cuts in eligibility for Federal tuition grants and student loans, with new rules suggesting low graduation rates, low placement rates, will be grounds for cutting funding.

Community College is supposed to be a good value, and a great stepping stone to a 4 year degree. However according to this study- Sinclair is mediocre at best.

Walletehub has released its list of the best and worst community colleges for 2017 and Ohio’s did not fare well.

None of Ohio’s 23 community colleges made Wallethub’s top 200 and all of the schools of southwest Ohio fell in the lower half of the rankings, according to the report. Wallethub ranked 728 community colleges.

Clark State Community College came in at 567, while Edison State Community College was ranked 622 and Sinclair Community College ranked 641. Cincinnati State Technical and Community College ranked 544 and Columbus State Community College came in at 669.

The rankings were decided based equally on three factors including a cost and financing category which considered tuition price and some states that offer free community college. The other two main factors were educational outcomes which included retention and graduation rates and career outcomes which considered loan default rates and salaries of grads, according to Wallethub.

Source: Ohio Community Colleges get low rankings in new report

If it wasn’t for Columbus State Community College, Sinclair would rank worst in the state.

And for this ranking- they increased our taxes 2 years ago with a second smaller levy- and now, claim we need to renew their larger levy to keep growing- inside and outside Montgomery County.

It’s time to demand accountability, and justify the continued funding of an institution that doesn’t pay its staff well, refuses to allow the teachers to unionize, has an abundance of highly paid administrators including a President making $411,570

The top five:

- Steven Johnson, president: $411,570

- Dave Collins, senior vice president of provost’s office: $170,566

- Jeff Boudouris, vice president and CFO: $170,566

- Deb Norris, senior vice president of Workforce Development: $168,474

- Madeline Iseli, senior vice president of advancement: $164,487

Note, Norris left the fall, after years of not hitting goals and setting up a very expensive training space at Austin Landing.

It’s time to expect more and pay less for Sinclair Community College until they score much higher on the value delivered scale. Notice, all those high paid executives- and not a single actual professor makes the top 5.

Administrators topped Sinclair’s payroll. The 11 highest-paid employees had the name “president” or “provost” in their title. The top grossing faculty member ranked 13th: biology professor J. Michael Erbe, who made $139,121 last year. ibid

It’s time to improve teaching performance and cut the pay of the presidents.

Tax credits for Preble County Sinclair facility

In Montgomery County, we pay a property tax to support Sinclair Community College, in Preble County- Ohio Preservation Tax credits are issued to help fund additional buildings for Sinclair that Preble County residents have access to tax free.

In Eaton, a project to create many uses for the former Eaton High School, 307 N. Cherry St., was awarded a $2 million tax credit. That project will cost $12.3 million.

The building was constructed in 1926 and served students until 2004. A partnership between Miller Valentine Group and the H.I.T. Foundation will make the building home to affordable senior housing, A community-use location in the former gymnasium and auditorium, and space for Sinclair Community College programming. The tax credit allocation replaces a previous award that was approved for the project.

Source: Developer of Dayton site gets $687,500 in tax credits

Yet another reason to vote against any further Sinclair Tax levies.

The Letter to the Editor- and the one the Dayton Daily wouldn’t publish

Today, the Dayton Daily news published our short letter to the editor. Right next to a longer anti-pot piece by Bob and Hope Taft. Originally, they’d said they’d let us have 650 words- which we carefully crafted. Their reasoning for not publishing the original and the full letter, follow today’s letter. Note, they had no problem using much of our research in their really long article last Sunday.

Reader’s alternative to Sinclair levy

Since 1966, Montgomery County taxpayers have never said no to a Sinclair Community College tax levy for our county, the one with the second-highest tax burden in the state.

About a dozen years ago, Sinclair built a campus in Warren County. The school claims zero Montgomery County funds are spent outside Montgomery County and the costs of the services that they now provide in Warren, Preble and Greene County are funded entirely with the $50 extra per credit hour they charge students from those counties.

If that’s truly the case, instead of taxing Montgomery County residents with a second levy why not raise tuition $50 per credit hour, and we don’t pay any Sinclair tax?

Sinclair has zero debt and refuses to float bonds to finance capital improvements. This is unlike every other state school.

If you really want to “Make Sinclair Strong” — we the people of “Keep Sinclair Fair” www.keepsinclairfair.org suggest that you vote no on Issue 13, and for any other Sinclair levy, until they tax the residents of Warren, Greene and Preble counties as well.

— DAVID ESRATI, DAYTON

“I think there are some good points you make, but there are just as many points that seem unsubstantiated and yet stated as fact. Overall, it doesn’t feel like a guest column of this length to me. I’d be OK with it as a shorter letter to the editor, in the 180-200 word range. If you want to resubmit in that form, I’d need it back pretty quickly to run in the early part of next week.”

Ron Rollins

Here is the letter they should have run:

Montgomery County has never said no to Sinclair Community College since they started taxing us in 1966. Publicly opposing Sinclair is akin to blasphemy. Yet, it’s time to vote no, and make Sinclair stronger, despite what their expensive levy campaign says.

For the last 12 years, Sinclair has been working outside of Montgomery County; they built a real campus in Warren County, a hybrid campus in Preble and are teaching courses in Greene County- all counties that pay no taxes to support them. It’s time to Keep Sinclair Fair and demand that those counties contribute for the Sinclair that we built.

Sinclair’s administration, that has grown by leaps and bounds since Dr. Steven Johnson took over from the legacy of the revered Dr. David Ponitz, has repeated over and over that “No Montgomery County funds” have been spent in the neighboring untaxed counties. And for some reason, that patently untrue statement has been accepted by us, the residents of Montgomery County; who are struggling with the second highest tax burden in the State (after Cuyahoga).

We have seen businesses leave Montgomery county for lower tax rates in Greene and Warren County (the “fastest growing” county in the State) for the last 20 years. We have seen our local governments grant huge tax abatements to large companies as part of “economic development” – instead of realizing, that high tax burdens are contributing factors in foreclosures, business failures, and outward migration. When the “leaders” of our community say we’re building a future on “Meds, Eds and Feds”- they don’t mention that these organizations don’t contribute property taxes, forcing the rest of us to subsidize their infrastructure.

If the true costs of the expansion to other counties is really covered by the $50 more a credit hour that those students pay, by the same logic, we could eliminate the existing levy and just boost tuition by $50 a credit hour (still a great deal) and pay no property tax at all.

All of us have benefited from Sinclair, even if we’ve never attended. The dental hygienist who cleans your teeth is a probable graduate, and many nurses and home health aides have come through Sinclair. My own business has hired Sinclair grads in the past, but will no longer. A private school, SAA in Kettering, prepares students much better, in the same time. They receive no subsidy from all of us, but produce much more qualified graduates.

According to many friends who work, or have worked at Sinclair, that since Dr. Johnson took over the school is relying more on part-time, low paid temporary professors. The school has also moved from a mantra “find the need and endeavor to meet it” to “invent the need and endeavor to hype it”- if you need proof, they’ve sunk $9 million dollars to train drone operators, and $0 to train truck drivers. Look in the Sunday classified section to see which field has more job openings?

It should concern us all that increasing numbers of high school students are receiving Sinclair credits. This might be part of the reason that a Bachelors degree is now looked at as the equivalent of the high school diploma 50 years ago. Besides devaluing both the High School diploma and the Sinclair degree, it’s time that Ohio’s unconstitutional system of funding public education needs fixed first.

Another Ponitz legacy was not borrowing for capital investment. It made sense in his tenure of high interest rates, but for Sinclair not to float bonds for capital projects while interest rates are at an all time low is stupid. Sinclair is the only public education institution that is debt free- thanks to your high taxes.

It’s time to keep Sinclair fair, and strong. Ask all the served counties to share in the investment via property tax, before voting yes to another Sinclair levy.

Can you tell what’s unsubstantiated?

Dayton Daily news endorses big campaign cash

After rejecting our 650 word anti-Sinclair levy op-ed piece, with

“I think there are some good points you make, but there are just as many points that seem unsubstantiated and yet stated as fact. Overall, it doesn’t feel like a guest column of this length to me. I’d be OK with it as a shorter letter to the editor, in the 180-200 word range. If you want to resubmit in that form, I’d need it back pretty quickly to run in the early part of next week.”

Ron Rollins

We sort of knew our points wouldn’t make it into the Sinclair Daily News. They’ve run at least a half a dozen pro-Sinclair articles on the front page in the last few weeks.

Today, they managed to point out that only 6 of 23 community colleges get any tax levy- never mind 2 levies. However, they still refuse to acknowledge that Sinclair isn’t honest when they say no Montgomery County money is spent outside Montgomery County.

At least KeepSinclairFair.org got a mention- but, because we’ve raised less than $1,000 and aren’t spending it on Cox’s TV stations, radio, or newspaper- we’re not worthy of coverage.

But in Ohio, it’s not all that unusual. According to the Ohio Department of Higher Education, six of the 23 community colleges in the state augment their tuition revenue with property tax levies.

Sinclair is one of them, and it is asking voters on Nov. 3 to support a 1-mill levy that the school says will allow it to ramp up its health and manufacturing programs. It is the only countywide levy in Montgomery County, and would cost the owner of a $100,000 home about $35 a year.

That’s in addition to the $98 those homeowners already pay for Sinclair’s 3.2-mill levy, which passed in 2008.

Sinclair President Steven Johnson said the new money would be used to build a health center, which would house its nearly 40 health science programs and be equipped with the “latest” simulation labs and clinics. The center would be built on a parking lot between 4th and 5th streets, and attached to the Sifferlin Center.

“In order to have enough trained health care workers, and people to work in manufacturing, we need to increase capacity and we need to do it faster,” Johnson said.

The levy, which would raise about $8.5 million, would also help the school prepare students to address the “skills gap” that employers point to as a barrier to growing jobs in the region, said Johnson.“Sinclair has tremendous momentum going in workforce and job training programs like UAS, health science careers, advanced manufacturing, IT and first responders,” he said.

Maybe this is why Sinclair has received over $130,000 for their campaign from our duopoly health care system- who don’t have to pay property taxes.

But to people like Meyers, another levy request is too much to ask, particularly for those on fixed incomes.“And next year there isn’t a Social Security increase,” he said.

Meyers said if local businesses are “begging for employees” they should carry more of the burden for Sinclair’s job training programs.“

I got grandkids in the area, and I’m all for education,” he said. “But what if they want to go to another school?”

Final push

Supporters know any levy is a tough sell in a county that already has its share of levies. Montgomery County property owners, because of those levies, have the second highest property tax burden in Ohio.

Finally- our point makes it into the discussion. Remember, Warren County is the “fastest growing county” in the state- and now has a Sinclair campus- without a tax burden. We’ve all paid for 49 years- and Warren County residents only have to pay for Sinclair if they go to Sinclair- novel idea.

With just nine days until Election Day, Citizens for Sinclair — the group pushing Issue 13 — is out in full force, from taking to the airwaves to handing out yard signs and announcing endorsements.

Johnson remains confident, but he says the outcome will depend on turnout.

To ensure they get that turnout, Citizens for Sinclair has spent slightly more than $450,000 during the most recent reporting period, and has about $263,000 on hand.

More ads are planned for the campaign’s final days.

Johnson said a big selling point for the school is its value to local students.

No mention of Sinclair’s 11% graduation rate. Value? Really?

Some voters have questioned why Sinclair isn’t asking voters in Warren County — where the school opened a campus in 2007 — to pony up.

But, said Johnson, “By law, we keep it here. And it’s spent on our (Montgomery County) students.

”Sinclair officials point out that Montgomery County students pay $99 per credit hour, while students from other Ohio counties pay an additional $50 per credit hour.Currently, Sinclair pulls in slightly more than $27 million each year from property taxes.

No, this is a flat out lie. Montgomery County Students pay $99 per credit hour, plus, all of us pay based on our property value, pay for their tuition.

In Warren County- only the students who go pay.

Strengthen finances

Sinclair officials say the community college doesn’t have debt and its financial outlook is solid.

“We’ve only bought and paid for things we could afford,” Johnson said.

No, they could only buy and pay for things we pay for. And any alternative funding sources, such as issuing bonds, which is how every other state school finances capital improvements, is ignored. Which, considering the record low interest rates, borders on criminal negligence on the part of Sinclair in showing shrewd financial decisions in our best interest.

However, the school says it has faced its share of financial hurdles, including lower-than-expected levy funds as a result of falling property values.

In 2016, the college is expected to receive $700,000 less from property taxes than it did in the most recent fiscal year.

That’s one reason the college’s revenue is projected to fall by $3 million to $124.2 million from fiscal year 2015 to 2016.

Meanwhile, its 2016 expenses are expected to drop by $4.2 million, to $121.4 million.

No analysis has been provided of the growth of highly paid administrators and cuts to tenured faculty positions under Johnson. There has also been a declining enrollment in recent years, which isn’t being reported. Is it because the focus on pie-in-the-sky programs like model airplane pilots instead of truck driving programs like those offered by other community colleges- where there are real, open jobs waiting?

Aside from levy funding, the college will rely mostly on state appropriations and tuition to cover 2016 expenses. Those revenue sources also have dipped.The new levy would run for eight years. In 2017 or 2018, the college will move to renew its 2008 levy, and after that— if the new levy passes— the college would have a levy on the ballot every five years.

Sinclair says having two levies could keep the institution’s finances secure, in case one were to fail. That’s not an uncommon levy strategy. In fact, the Montgomery County Human Services levies have a similar setup.“One of things that we would like to do is not have all of our eggs in one basket, and have balanced levies and spread the risk,” Johnson said last month.

Grant Neeley, associate professor and interim chair of political science at the University of Dayton, says Sinclair and other institutions that have two levies run the risk of confusing voters.

“I think levies are confusing for most people anyway,” Neeley said.He added that it’s also possible the increase in levies could cause voter fatigue.

Local support

Earlier this month, more than a dozen local officials gathered in the Kettering Tower to announce their support for the

Sinclair levy. The gathering included politicians on both sides of the aisle.

“We don’t agree on much, but we need to educate our future leaders,” said Sheriff Phil Plummer, the chairman of the Montgomery County Republican Party.

The levy doesn’t have much organized opposition, aside from keepsinclairfair.org — a webpage that has raised less than a $1,000.

Amazing, we finally get mentioned.

The community college has had a great track record with passing levies. The school passed its first levy in 1966, and has passed each renewal since.

Johnson says that’s because Sinclair has had a good relationship with the county during its 128-year existence. In addition, Johnson said those levy funds helped the school build technical programs that rival the best community colleges in the country.

He said if the levy fails Sinclair won’t be able to expand its offerings and “we will be facing (job) shortages in some key areas.”

Local hospitals are among the levy’s biggest backers. Of the $247,220 raised by Citizens for Sinclair from July 1 through October 14, $130,000 came from the Kettering Health Network and Premier Health Partners.

“We have more employees of our hospitals, of our 33,000 employees at 28 hospitals, that come from Sinclair than any other educational institution,” said Bryan Bucklew, president and CEO of the Greater Dayton Area Hospital Association.

Bucklew says his organization provides Sinclair with a vacancy report, so the community college knows what areas are in highest demand.

“This ranges from IT to medical technicians, surgeon technicians, phlebotomist,” he said. “Those certificate and associates degree programs at Sinclair provide for great quality training and great quality employees.”

Source: Sinclair looks to levy money to close ‘skills gap’

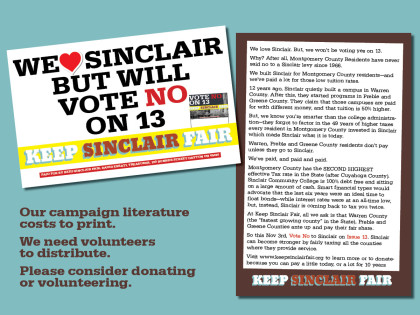

We still could put donations to good use- buying ads on social media to explain that voting no on Sinclair levies until they tax the other counties, is what would really “Keep Sinclair Strong.”

We won’t waste your money on TV ads, convincing you that while other counties grow like crazy, we keep being asked to tax ourselves into the ground, to support Premier and Kettering Health Networks job training programs.

Largest donors to Issue 13 don’t pay the tax

Those that don’t pay, and those that get paid, were the leading donors to Issue 13, which adds a second tax levy to support Sinclair Community College. Leading the way were the two hospital systems who donated over $130,000 to the campaign. These “not-for-profit” institutions, where their C-level executives make seven figure salaries, and yet pay nothing in property taxes- find it fits their budget to subsidize the levy campaign- since they rely on Sinclair to pay for training for their employees.

If we removed their tax-exempt status, and asked them to pay property taxes, there would be no need for an additional levy. Removing tax exemptions to any company where the C-level executives make over a million a year would be a good start toward solving income inequality in the United States.

Other large donors include kickbacks from the people the campaign spent over $360,000 proving that Sinclair levy’s are good for some businesses, while making the rest of us less competitive with higher taxes Note, Burges & Burges isn’t even a local firm- with Sinclair feeling the need to go to Euclid- a suburb of Cleveland for their campaign.

Sinclair Community College levy

In Montgomery County the largest total contribution went to the Sinclair Community College levy campaign, according to pre-general election campaign finance reports filed Thursday with the Montgomery County Board of Elections.The campaign for the 1-mill, 8-year additional property tax levy raised $247,220, more than half from Dayton’s two largest hospital networks.

Combining that with money brought forward from earlier fundraising, Citizens for Sinclair spent $452,532 and has on hand $263,524 going into the final leg of the campaign. The money was spent primarily on advertising buys for television, radio, print and direct mail.

“Those employers and individuals who have contributed certainly see this as an investment in the community,” said Madeline Iseli, vice president for advancement for Sinclair and campaign executive on loan from the college. “Sinclair is about helping them have the educated and trained employees that this community needs so that we can continue to grow the jobs for today and tomorrow.

”The new operating and capital improvement levy would pay to boost manufacturing and health programming, including building a new health sciences facility.If approved by voters the new levy would be one of two used by the school for its Montgomery County programs and students. Sinclair’s other levy is for 3.2 mills and officials say the new levy would help offset revenue losses on that levy stemming from declines in property values in the county.

The largest contributor to the levy campaign was Premier Health, with $100,000, followed by Kettering Health Network, which contributed $30,000. Iseli said 40 to 50 percent of the college’s health sciences graduates are employed by those hospital systems.

“We have just been really strong partners for many many years,” said Peggy Mark, chief learning officer for Premier Health. “We get great graduates from Sinclair.

”Kettering Health Network Chief Executive Officer Fred Manchur said the company is grateful to Sinclair for educating so many of its employees and “education produces a strong local workforce.

”Other large contributors to the campaign included the Montgomery County Human Services Levy and the University of Dayton, both of which gave $10,000 each. Sinclair President Steven Johnson gave $5,000 and the levy attracted $3,000 in financial support from levy campaign consultant Burges & Burges Strategists of Euclid and $5,000 from The Ohlmann Group Inc., the Dayton marketing and advertising firm that does media buys for the levy.

The levy committee paid Burges and Burges $33,324 for services during the reporting period. Ohlmann was paid $332,871 for media buys.

Source: Issue 3 backers spend $15.3M

The myth of “No Montgomery County Money” spent in Warren County

We love Sinclair. But, we won’t be voting yes on 13.

Why? After all, Montgomery County Residents have never said no to a Sinclair levy since 1966.

We built Sinclair for Montgomery County residents—and we’ve paid a lot for those low tuition rates.

12 years ago, Sinclair quietly built a campus in Warren County. After this, they started programs in Preble and Greene County. They claim that those campuses are paid for with different money, and that tuition is 50% higher.

But, we know you’re smarter than the college administration—they forgot to factor in the 49 years of higher taxes every resident in Montgomery County invested in Sinclair which made Sinclair what it is today.

Warren, Preble and Greene County residents don’t pay unless they go to Sinclair.

We’ve paid, and paid and paid.

Montgomery County has the SECOND HIGHEST effective Tax rate in the State (after Cuyahoga County). Sinclair Community College is 100% debt free and sitting on a large amount of cash. Smart financial types would advocate that the last six years were an ideal time to float bonds—while interest rates were at an all-time low, but, instead, Sinclair is coming back to tax you twice.

At Keep Sinclair Fair, all we ask is that Warren County (the “fastest growing county” in the State), Preble and Greene Counties ante up and pay their fair share.

So this Nov 3rd, Vote No to Sinclair on Issue 13. Sinclair can become stronger by fairly taxing all the counties where they provide service.

Recent Comments