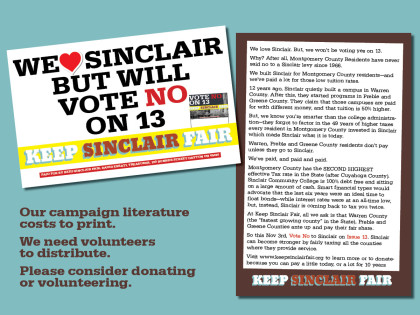

We love Sinclair. But, we won’t be voting yes on 13.

Why? After all, Montgomery County Residents have never said no to a Sinclair levy since 1966.

We built Sinclair for Montgomery County residents—and we’ve paid a lot for those low tuition rates.

12 years ago, Sinclair quietly built a campus in Warren County. After this, they started programs in Preble and Greene County. They claim that those campuses are paid for with different money, and that tuition is 50% higher.

But, we know you’re smarter than the college administration—they forgot to factor in the 49 years of higher taxes every resident in Montgomery County invested in Sinclair which made Sinclair what it is today.

Warren, Preble and Greene County residents don’t pay unless they go to Sinclair.

We’ve paid, and paid and paid.

Montgomery County has the SECOND HIGHEST effective Tax rate in the State (after Cuyahoga County). Sinclair Community College is 100% debt free and sitting on a large amount of cash. Smart financial types would advocate that the last six years were an ideal time to float bonds—while interest rates were at an all-time low, but, instead, Sinclair is coming back to tax you twice.

At Keep Sinclair Fair, all we ask is that Warren County (the “fastest growing county” in the State), Preble and Greene Counties ante up and pay their fair share.

So this Nov 3rd, Vote No to Sinclair on Issue 13. Sinclair can become stronger by fairly taxing all the counties where they provide service.

I live in Greene County and attended Sinclair Community College. Even though I owned rental properties in Montgomery County I paid higher non-resident tuition so I believe Greene and Warren County residents have and are paying their fair share.

Thank you for your comment Judy. But, by your standard, Sinclair Community College could end all of the levy’s and just charge Montgomery County Residents an additional $50 a credit hour – and all would be fine.

We know that’s not the case.

It’s time, Warren and Preble Counties- that have campuses in their county- pay their fair part in taxes- before Montgomery County takes on even more of a burden.

If it’s good for Montgomery County- why isn’t a levy good for Greene, Warren and Preble?

From Sinclair’s audited financials:

“Montgomery County Levy: The levy is used entirely for expenditures benefiting students who reside in Montgomery County in the form of tuition subsidy and support for services at the Dayton campus and the Englewood and Huber Heights learning centers. Since the current 3.2 mil levy was passed in 2008, property value declines and legislative actions have reduced the levy proceeds by about $7 million or 20%. This includes a reduction of approximately $1 million that becomes effective in 2015 due to lower property values arising from the recently completed property revaluation process.”