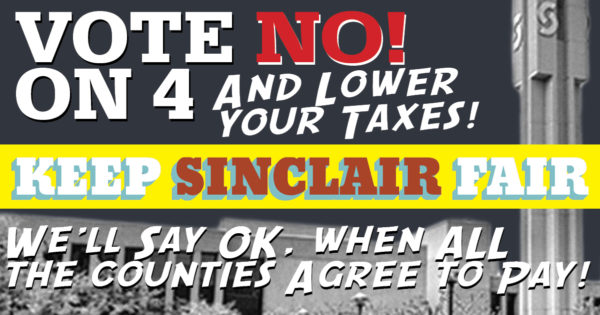

Sinclair has never lost a levy campaign. They’ve also never thought twice about opening campuses outside Montgomery County where they don’t collect a property tax. Until they tax everywhere equally, it’s time to say no.

VOTE NO

ISSUE 10

NOVEMBER 8TH

Latest News and Developments

Keep Sinclair Fair finally recognized in Dayton Daily

After 52 years of paying for Sinclair levies without public organized opposition, the Keep Sinclair Fair movement finally gets a mention in the Dayton Daily News:

After 52 years of paying for Sinclair levies without public organized opposition, the Keep Sinclair Fair movement finally gets a mention in the Dayton Daily News:

But, a local group led by David Esrati said Montgomery County tax dollars are being used elsewhere.

In response to Issue 4, Esrati started an political action committee called “Reconstructing Dayton” and a website called Keep Sinclair Fair. The website encourages residents to vote against the renewal this fall.“I’m sure they’re spending Montgomery County tax dollars in other counties. You can’t have a branch campus in Warren County and have all the support … all the things that go along with it,” Esrati said. “That is not covered for $47 extra a credit hour.

”It’s not fair, said Esrati, that Sinclair has locations in neighboring counties but that residents of those counties are not taxed.

He pointed to Sinclair’s interest in buying Far Hills Church on Clyo Road as evidence because it sits immediately next to Wilmington Pike, which serves as the Greene County line. Sinclair may convert the 100,000 square-foot church and the 40 acres it sits on into a new learning center for $6 million to $10 million.

Esrati called for all counties Sinclair has facilities in to be taxed since Montgomery County residents already pay for Sinclair. Sinclair has locations in Preble County, Greene County, Warren County and a Huber Heights location that serves people from Miami, Montgomery and Greene counties.

Levies are not needed in other counties because Sinclair’s operations are substantially smaller than in Montgomery County, Johnson said. Although Sinclair has the authority to put a tax levy on the ballot in Warren County, Johnson said county leaders do not think one is needed right now.

“If at some time the leaders of Warren County want to have a levy … and want to have lower tuition and they want to have more programs and a bigger campus and all that stuff we’d be interested in talking to them about that,” Johnson said. “But, at this point in time, you know, the very small, modest thing that it is, is what it is.”

Source: Sinclair asks voters to renew $28M levy

The reality is, Sinclair is providing programs all over the region. Dayton School Board member John McManus is teaching high school government classes in Clark County, and then of course, there are branch campuses. Yet, Steven Johnson is still thinking other counties might “volunteer” to add a tax levy to support Sinclair Services.

Why should they? Sinclair is fine just taxing Montgomery County to death, and providing services and their brand without

Sinclair looking to buy church for yet another campus

The sprawling downtown campus isn't enough for Sinclair President Steven Johnson, he now wants to buy a church in Centerville to turn into yet another branch campus. Apparently, it's too far for people in Northern Warren County and the South Suburbs to drive to...

Sinclair Community College one of the worst values

Almost every public institution is worried about cuts in eligibility for Federal tuition grants and student loans, with new rules suggesting low graduation rates, low placement rates, will be grounds for cutting funding. Community College is supposed to be a good...

A Quick Math Lesson

Montgomery County residents pay 4.2 mills through 2 levies to support Sinclair Community College.

Warren County residents don’t pay any property tax, their students just “pay double the tuition.”

If you own a home worth $100,000, you would be paying $147 per year just to Sinclair.

If all it costs to run Sinclair is doubling tuition and no property tax, it’s time that Montgomery County property owners stop paying after 56 years. We’ll contribute again when all counties are taxed equitably.

Here’s the problem…

Montgomery County taxpayers already have the second highest tax burden in the state, following only Cuyahoga County.

Warren County is one of the “Fastest Growing Counties” in the country—and has a much lower tax burden.

Net Residential & Agricultural Rate (Source)

Cuyahoga

Montgomery

Warren

Preble

A Show of Good Faith

Montgomery County has funded a debt-free Sinclair for decades. From the first tax levy in 1966 to today, they have never been turned down.

To show their appreciation, Sinclair has extended services to Warren, Preble and Greene Counties—that pay no taxes in exchange.

Sinclair has zero debt and $50 million in the bank, and yet they ask overly-burdened Montgomery County taxpayers to dig in deeper while others freeload.